River's Report Highlights 30% Growth in Business Bitcoin Adoption in 2023

River, a prominent Bitcoin financial services provider, has released a comprehensive report detailing a significant rise in business Bitcoin adoption, showcasing a 30% growth in the past year. The report, titled Why Business Bitcoin Adoption Grew by 30% in 1 Year, offers a thorough analysis of the factors driving this increase and the current state of corporate Bitcoin holdings.

Key Findings from the Report

The report provides several key insights into the rapidly expanding presence of Bitcoin in business treasuries and operations:

Surge in Corporate Bitcoin Holdings: River identifies over 1,000 companies utilizing its services, pointing to a broader trend of corporate interest in Bitcoin. This aligns with the growth in publicly available data on corporate Bitcoin holdings, which has seen a 40% increase in the past year. The report lists 52 public companies with Bitcoin holdings, a notable rise from previous years.

Case Studies of Business Adoption: The report highlights case studies from seven companies that have integrated Bitcoin into their business models, including notable names like Block Inc., Real Bedford, Tahinis, and SummerPlace Homes. Each company offers unique insights into how Bitcoin can be leveraged, from treasury management to enhancing business operations.

““While Bitcoin has carved out a place within a dedicated niche community, there’s a significant opportunity to integrate it into traditional business models, where sound money can accelerate existing success. In the world of football, financial pressures are often overwhelming, with many teams struggling to stay afloat. By positioning Real Bedford as the Bitcoin team, we gained two key advantages:

1. Access to the global Bitcoin community, allowing us to build a dedicated fanbase.

2. The ability to build a Bitcoin treasury, ensuring long-term sustainability. The project has already seen tremendous success, and we’ve secured investment from Winklevoss Capital to further strengthen our treasury.””

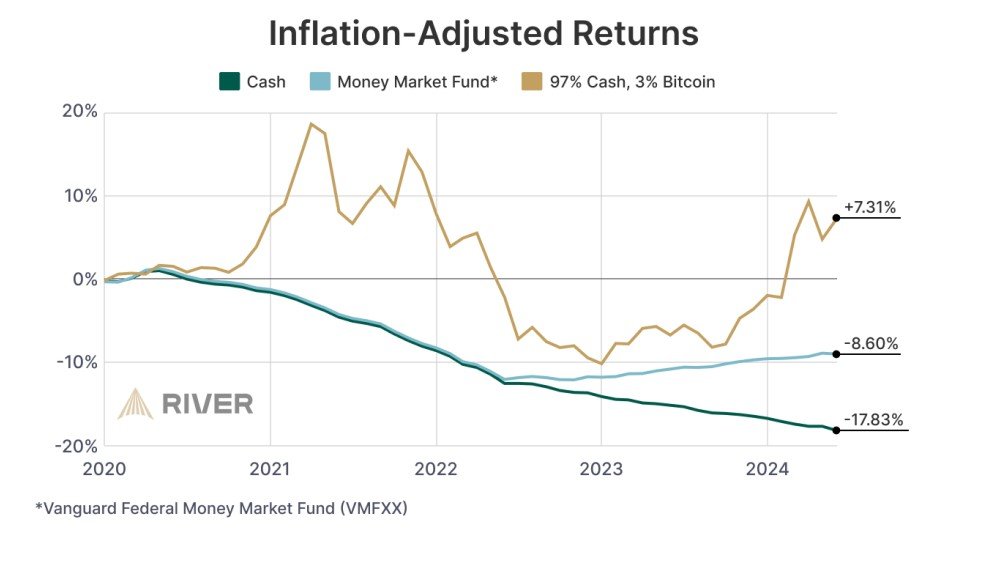

Bitcoin as a Treasury Asset: One of the report’s central arguments is the role Bitcoin plays as a hedge against the declining value of traditional business treasuries. With inflation and currency devaluation impacting business assets globally, Bitcoin is positioned as an alternative store of value that can preserve purchasing power over time.

Source: River

Treasury Risks and Inflation: River’s report also discusses the risks faced by businesses that hold large amounts of cash or fiat assets in their treasuries. As currencies lose value due to inflation, businesses see Bitcoin as a solution to mitigate this loss by diversifying their reserves.

River-Specific Insights: As part of the report, River shares its own observations and trends from the companies it serves, reflecting on how its financial services have been key in enabling businesses to adopt Bitcoin efficiently and securely.

Companies Leading the Way

River's report acknowledges companies that have actively contributed to the growing trend of Bitcoin adoption, praising them for their forward-thinking approaches. Block Inc., owned by Jack Dorsey, is one such example, as is Real Bedford, a UK-based football club owned by Bitcoin advocate Peter McCormack. Other companies like Tahinis, a restaurant chain in Canada, and SummerPlace Homes, a real estate company, showcase the diverse ways in which Bitcoin can be used across industries.

“Successful franchise restaurants often rely on more than core-business cash flows. For instance, McDonald’s owes much of its success to real estate ownership, now making up 80% of its assets. Inspired by this model, Tahiniʼs has adopted a treasury strategy that invests 100% of its profits into digital real estate in the form of bitcoin.”

Bitcoin Business Payment Solutions. Source: River

Great Work Team River!